But you also had to go on depreciating the building components you replaced along with the rest of the original structure.

Roof replacement on business building depreciation.

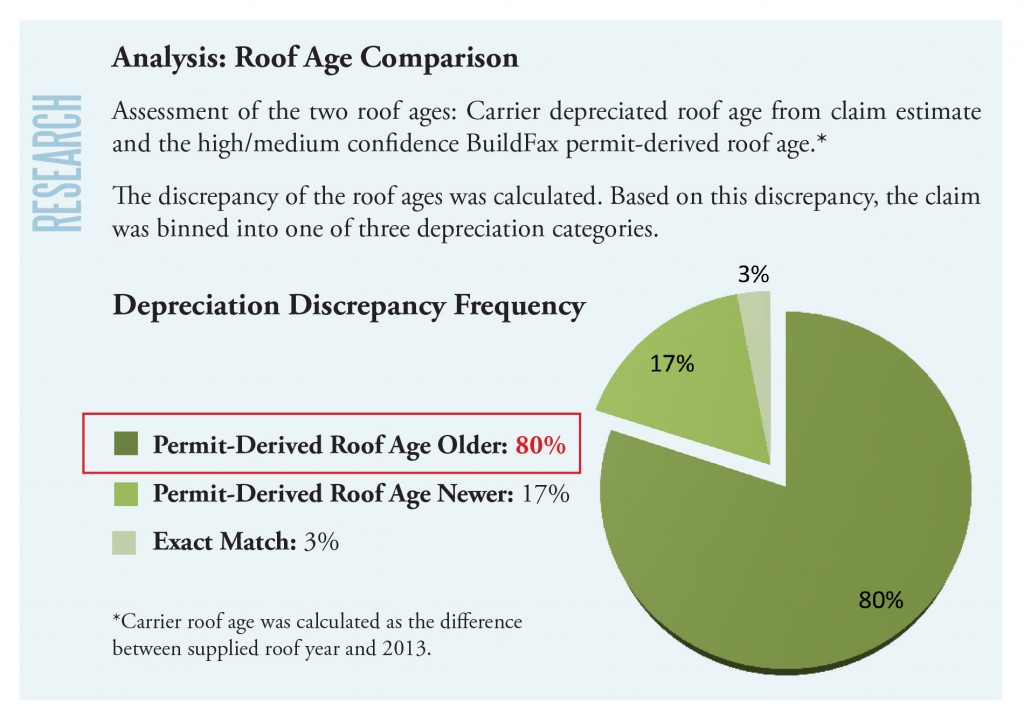

One of the most frustrating things for commercial property owners has been that their roof needs replacing long before its depreciable life runs out.

This proves to be an excellent opportunity to take advantage of the all time high section 179 tax deduction to solve problems with your roof that have been plaguing your facility.

Your roof s depreciable life has been shortened by about 36.

Permitting the depreciation of roofs on a shorter more realistic schedule would encourage building owners to incur the added expense of replacing older less efficient roofs.

Armed with a basic understanding of roof systems and the tangible property regulations tax preparers can ask insightful questions to assemble the facts and circumstances and evaluate the nature of the work performed.

179d tax deduction allows commercial property ownersto deduct the full cost of a roof replacement in the year it s completed vs.

The irs uses the straight line method to calculate the depreciation of your roof which means that the depreciation of your roof is calculated evenly across a set period of time.

800 638 6869 mon sat.

However changes in the tax law allowing owners to expense a new commercial roof in a single year might make installing a new commercial roof less of a financial burden for businesses.

Replacing the roof of your commercial building is an important expense for your business and thanks to the new amendments to section 179 the cost of a new roof does not have to cripple the expansion of your business.

Depreciating over 39 years.

Therefore the furnace replacement is a capital improvement to your residential rental property.

The tax cuts and jobs act approved by congress in december 2017 under section 179 allows building owners to deduct the full costs of a roof replacement up to 1 million in the year it s completed.

These improvements include roofing repairs waterproofing and even full reroof projects on existing buildings.

The irs states that a new roof will depreciate over the course of 27 5 years for residential buildings and over the course of 39 years for commercial buildings.

Building owners often spend significant amounts to replace portions of various roof system components.

Because the average life of a commercial roof is just under 20 years the 39 year depreciation schedule for commercial roofs makes little business or environmental sense.

The new tax law shortens the commercial roof depreciation schedule from 39 years to 25 years that s an enormous difference.

Is generally a restoration to your building property because it s for the replacement of a major component or substantial structural part of the building s hvac system.

If you are ready to replace your roof contact the professionals of reliable roofing.